Drawing cash from an ATM is beginning to feel like a ritual from a bygone era. Like buying a record on vinyl, it’s a once-universal experience for which dedicated fans are now paying a premium.

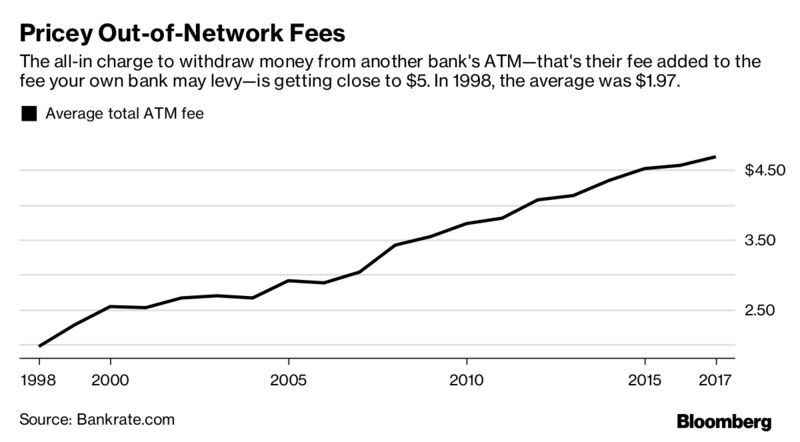

This year marks the 11th consecutive annual increase in bank ATM fees for customers using out-of-network machines, according to a new Bankrate.com report. Over the past decade, such fees have risen 55 percent. The average cost of such a transaction is now over $4.50, and N65.

ATM fees aren’t rising due to overwhelming demand. In fact, it’s the opposite. “It keeps getting easier to avoid the fees, and people are transitioning away from cash,” said Greg McBride, Bankrate.com’s chief financial analyst. “With fewer people making out-of-network ATM withdrawals, the cost of maintaining that network is being spread over fewer transactions.”

The report looked at the 10 biggest banks in the top 25 major metro areas to find out where average ATM fee surcharges are the steepest and where they are … slightly less steep. Pittsburgh experienced the highest average fees, with customers paying $5.19 when Bankrate.com combined the fees charged by the ATM operator with fees from the consumer’s own financial institution. The lowest average fees were found in Dallas, at $4.07 and nigeria 65 naira and 100 naira monthly service charge .

Customers with higher account balances or multiple relationships with their bank—as in a checking account, a mortgage and a personal loan, for example—may avoid out-of-network ATM charges from their bank or be reimbursed for some of them.

The average overdraft fee reached a new high of $33.38, up from $33.04 in 2016. Philadelphia consumers pay the highest average overdraft fee, at $35.30. In San Francisco, average overdraft fees are the lowest of the top 25 metro areas, at $31.44. Banks hiking that fee last year outnumbered those trimming it, by seven to one.

The Consumer Financial Protection Bureau zeroed in on overdraft fees in a recent report (PDF). Consumers who pay a lot in overdraft fees “tend to be more credit-constrained,” to have lower credit scores and be less likely to have a general purpose credit card, it found. That means overdraft fees can weigh heavily on already fragile finances.

In the wake of the CFPB report, “we are seeing a little more latitude given to consumers by their banks,” said McBride. If someone overdraws by only a few dollars, the bank may charge a smaller fee or completely forgive the infraction, he said. It’s a small mercy in a land of big fees.

No comments:

Post a Comment